(R)Evolution of Storage Systems

Development and outlook

Storing solar power used to be an issue only in remote locations, off the grid or for emergency applications.

However, parallel to the move from full feed-in tariffs to self consumption and rising electricity costs, consumer demand for independence has grown in recent years. The market for storage systems gained momentum and storage systems have become an indispensable part of a functioning energy transition.

The speed at which storage technology has developed is rapid. We ask ourselves: What has been the development in the last few years and where do we stand today? After all, we give you an insight into our current storage portfolio with our detailed storage overview for download.

A brief look back in time and a forecast

Battery storage for solar power increasingly entered the market from 2011 onwards. At that time still as a niche product and with restrained sales and demand from consumers. For a long time, the economic viability of photovoltaic home storage was a major challenge and technologies had to develop first.

With our picture gallery, we dare to take a small look back at the storage systems of the last years and also look at the current market.

Storage systems on course for growth

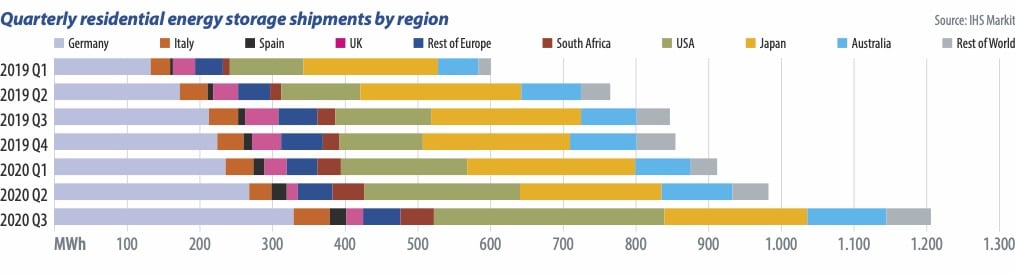

Currently, 90 % of home storage systems are installed together with a photovoltaic system. Accordingly, their market development is essential for the sale of home storage systems. The growing number of electric vehicles is also driving photovoltaic installations and home storage systems. The continuing positive trend for solar systems in the residential sector is thus ensuring new installation records for home storage systems. This trend is particularly evident in Germany. But a clear market development can also be seen worldwide.

Source: IHS Markit

Italy is currently the second largest market for energy storage in Europe. Followed by Spain, Austria, and Switzerland (the latter are not displayed in the graphic). In Belgium, there was an abrupt end to net metering, so that the storage market and the trend towards self-supply can also be expected to flourish here. Overall, we see that there is a transition from a pure PV market to a PV and storage market in many markets. However, we believe that the analyses and forecasts do not meet the real figures, as the markets are much larger than predicted.

From niche to mainstream through lithium-ion technology and falling prices

A lot has changed since the beginning of the commercial success of battery storage. There has been massive progress, especially in cell technology. While in the early days lead-acid batteries were used as the majority storage technology because they were cheaper, lithium-ion batteries soon quickly gained market share. For a long time, lithium-ion and lead-acid batteries thus competed for supremacy. Meanwhile, lithium-ion batteries have prevailed on the market due to their technical superiority. The reasons for this remarkable success of lithium-ion batteries over lead-acid batteries or the more modern lead-gel batteries are diverse: Technically, lithium-ion batteries offer maintenance-free operation, promise a longer service life and exhibit better efficiency.

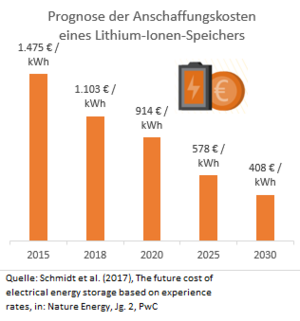

From the customer's point of view, however, two main advantages seem to prevail. First, because of their very high energy density, lithium-ion home storage units are much more compact and can be mounted on walls, which allows for more efficient use of space and is perceived to be more visually appealing. The second reason is pricing. Over the last ten years, the price per kilowatt-hour for lithium-ion batteries has dropped dramatically.

The increase in energy density by double in the last ten years and the falling cost of lithium-ion batteries have not only strengthened their market share, but also helped to bring the entire storage market segment more into the mainstream. Energy density is expected to double again by 2030 at most, and the cost of lithium-ion storage will continue to drop rapidly through 2030. One reason for the price change is the learning and economies of scale on the part of the manufacturers and at the same time the world market prices for batteries have fallen.

Interestingly, while prices per kWh have fallen in recent years, the average system cost of storage has remained virtually unchanged at around €10,000 (incl. VAT). The reason for this is the steady increase in battery capacity since 2014. To keep it simple, consumers seem to have invested every euro saved by cheaper batteries in larger storage capacities. For example, in recent years, storage sizes in European markets have increased from 4-5 kWh initially to 6-7 kWh with a tendency to increase to 10 kWh and larger. Sector coupling in the home also plays a major role. Home storage systems in combination with heat pumps are in demand, as is the ability to charge one's own electric vehicle. Electromobility will become an extremely large driver for solar power in the coming years. Large storage systems are a suitable solution for this sector coupling.

In summary, lithium storage technology is still in a disruptive phase. Manufacturers are regularly outdoing each other with new records in energy density, service life, charging performance, and are constantly launching new products with new features, while at the same time undercutting each other in terms of pricing and costs. We are curious to see where the (r)evolution of storage systems will go in the future!

Until then, we would like to give you an overview of the storage solutions we currently have in our portfolio with our storage overview for download. Use our overview also to find suitable alternatives if a desired product is not available or contact us directly via our contact form.